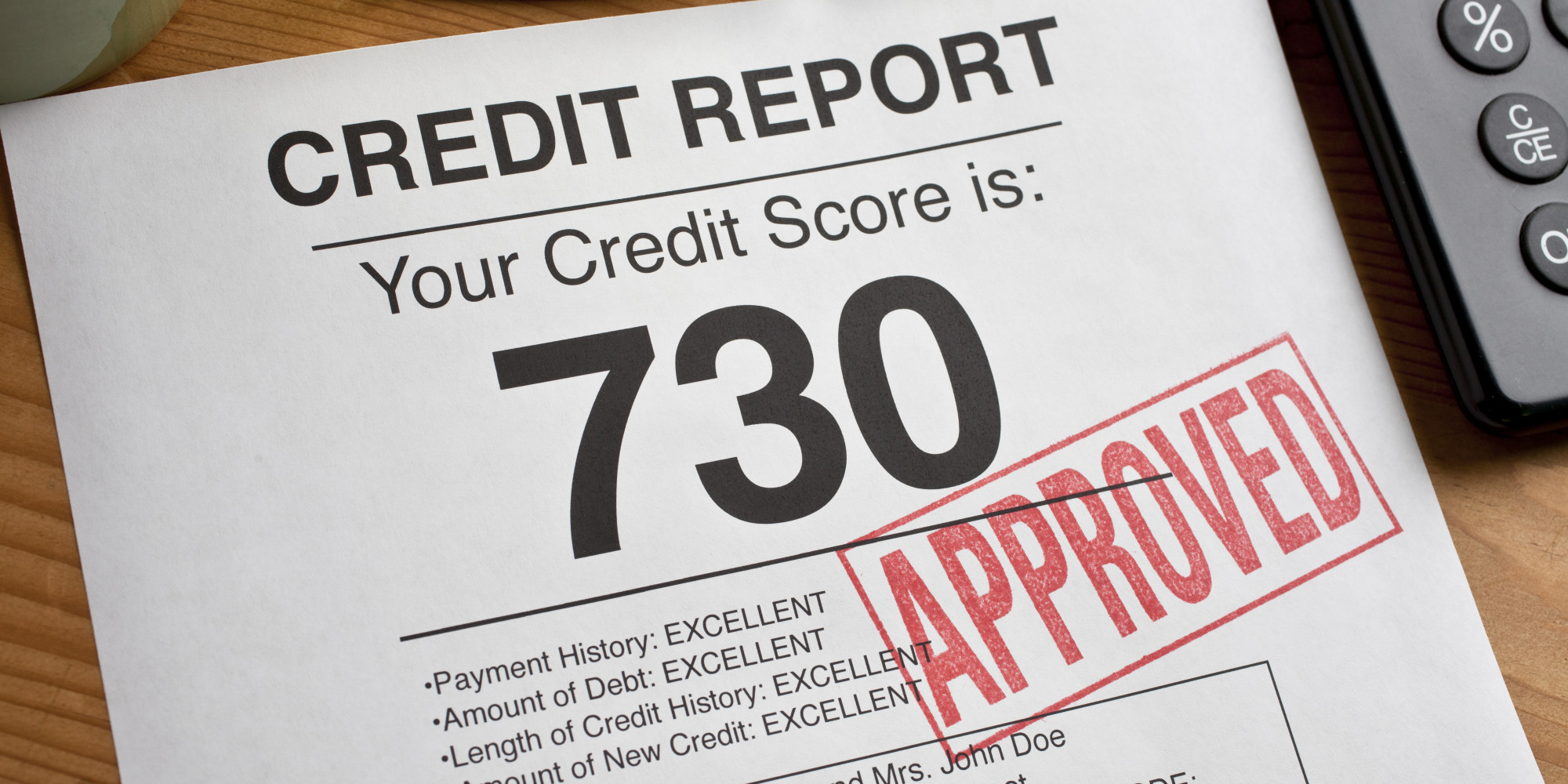

As you are most likely aware, the credit score is one of the most important numbers in your financial history. Once the credit score has been scarred with negative entries, it can be difficult to get the credit score back up to par and the process does not happen overnight. Once the credit score has been damaged it can be rejuvenated by taking measures to increase the score – but how do you maintain the score once it has been increased enough to guarantee the approval from creditors?

For the maintenance of good credit scores, you can read the instructions available in dmagazine for repairing credit score. There is a guarantee available to the creditors for the credit score. The collection of the information about the approval is essential for the people. There is an increase in the creadit score of the people.

Here are some ways that you can maintain the credit score once it has been established:

- Ensure that all bills are paid on time. The majority of your monthly payments are recorded and reported to the credit reporting agency. These payments are than tracked and can contribute to the 35% of the credit score that is used to calculate the entire credit score. This history is going to contribute to the score for as long as these accounts are open and therefore it is essential that positive history be created.

- Avoid any defaulted accounts that are going to collections. Collections accounts are one of the fastest ways to decrease the credit rating and should therefore be avoided. Defaulting on payments should be avoided and the consumer should have a system that enables them to create an organized system to ensure that all monthly obligations are met on time.

- Decrease your debt. The less debt that the consumer has, the higher the credit rating is going to be. Thirty percent of the credit rating is based on the amounts of debt that have been accumulated and have yet to be repaid. Those consumers that carry debt from month to month should examine this when creating a debt repayment plan. The quicker that the debt is removed from the credit rating, the quicker the consumer can maintain a higher score. Debt should be kept under 25-30% of the entire credit limit for the optimal results on the credit rating.

- Keep an eye on your credit report. Ordering a copy of the credit report once every six months, or at least every year enables the consumer to avoid any mistakes hurting the credit rating. The report contains valuable information which should be monitored. There are many companies that offer credit report monitoring, for a low price. Taking advantage of these companies could save you valuable points that a mistake on the credit report could cost you.

- Use your credit regularly. The more that you use credit, albeit wisely, the higher the credit score could potentially be. Be sure to remain active in all of your credit accounts to make the most of your credit rating and enable you to be approved for the credit that you apply for.