With planning, families can do much better in managing their money each month and putting savings away for planned expenses and emergencies. There are many different ways to set up a financial plan for your family. Financial plan can be divided into two categories:

Financial plan steps BEFORE having kids

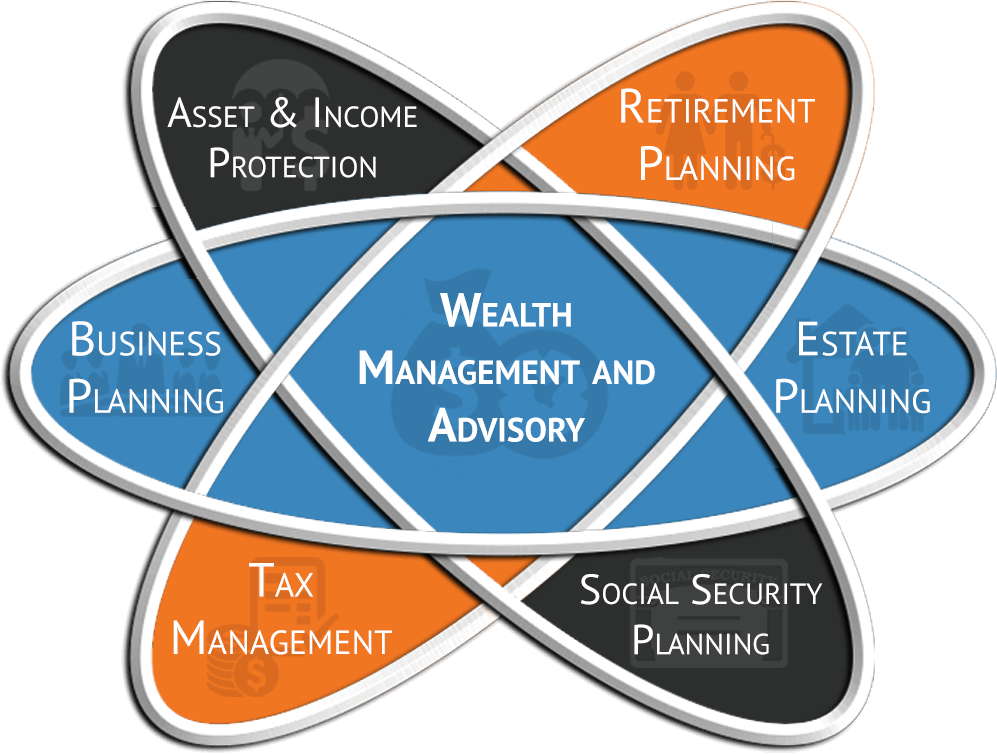

These are the most important factors you need to keep in mind because managing kids and their expenses is no easy task in current times when expenses are sky high even with two people in a family where it has become necessary to keep a wealth management advisor to take care of the accounts and provide advice on tackling financial issues.

- Identify the type of debt that you and your family have by assessing your family’s financial account. Analyze your financial management risk.

- Separate the amount of money for savings from the family’s total expenditure.

- If you plan to have kids, you should start a special savings account earmarked for baby related expenses like decorating a room, or buying clothes and furnishings. But keep in mind that pregnancy can be expensive; think of a way to reduce the cost, such as start saving early before having kids.

- Take the time to research the types of insurance and its coverage that is offered for all of your family, and its cost. Identify the type of insurance that you need and calculate the cost.

- Plan for future financial plan such as family financial plan, retirement fund, and children’s education.

- Reduce the used of credit cards in buying and paying or try not to apply it. Use it only during emergencies. It may be convenient but if not pay back on the specified time, the debts will increase. So it is not encouraged to have one.

- Keeping all the bills in one place and ready to pay when the time comes or when the money arrives. It is important when planning your budget to consider due dates and make sure you are meeting those deadlines.

- Going to the store less frequently and with a well planned grocery list will save you lots of money. A minor planning ahead will avoid the need to run out for very expensive fast food.

Financial plan steps AFTER having kids

- The cost of having kids is very expensive when they are still an infant. Do not buy some things that are of no use to the kids as it will be a waste of your money. Think before you buy.

- More saving than spending in your life.

- Try to have insurance that benefits your child and family.

- Start a saving account for your child when they are in their tender age. Or take time to consider the type of insurance for education. There are so many insurance and even saving accounts for a child’s education in the market now. This to help to reduce your financial burden.

- Help your child to start saving early and check their account regularly. Also, assist them to manage their finance. Teaching your children about good financial habits is vital in their future life.Try to have an emergency fund or account. This is a fully liquid fund that has safety of principal and is intended to provide cash for major emergencies.